Welcome to the EarlyBird guide that will equip you with a comprehensive understanding of the most common crypto investing strategies. Whether you’re a seasoned investor or just stepping into the world of cryptocurrencies, this guide will provide you with the knowledge needed to make informed decisions and potentially maximize your returns.

What You’ll Learn

In this guide, we’ll cover the following key topics:

- What is Crypto?

- How Do You Invest in Crypto?

- Different Crypto Investing Strategies

- Conclusion

- Summary

- Snapshot

Let’s dive into the world of cryptocurrency and explore the various strategies that can help you navigate this exciting and ever-evolving market.

What is Crypto?

Overview of Cryptocurrency

Cryptocurrency, often referred to as “crypto,” is a form of digital currency built on a decentralized global network. Unlike traditional currencies controlled by central banks, cryptocurrencies operate independently of government regulation.

The name “cryptocurrency” is derived from the encryption techniques used to secure these digital networks. Most cryptocurrencies employ cryptography to ensure the security and privacy of transactions. Instead of physical coins or paper notes, crypto balances are recorded on a publicly accessible ledger known as the blockchain.

Although transaction records on the blockchain are visible to all, individual records are encrypted to safeguard the privacy of all parties involved. New crypto transactions are validated and added to the blockchain through a process called “mining.”

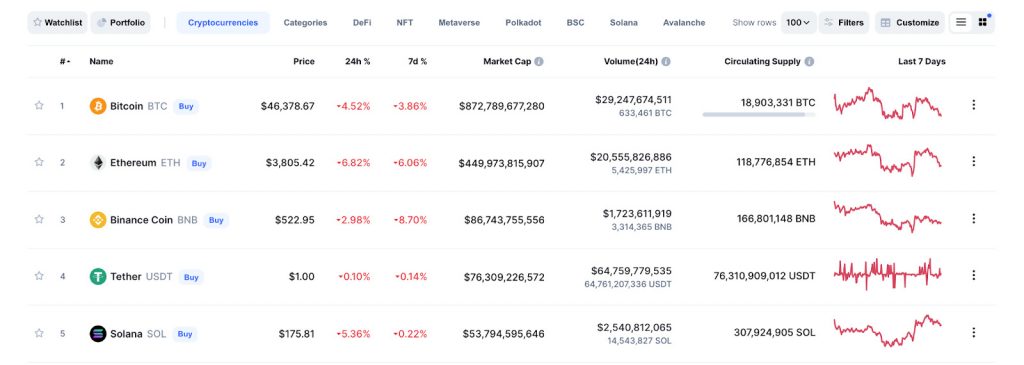

Investing in crypto may seem complex at first glance, but it becomes more straightforward with experience. Over the last decade, the cryptocurrency market has grown exponentially, with a total market capitalization of $2.13 trillion and more than 8,300 cryptocurrencies as of December 2021.

While you may be familiar with popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), not all digital currencies are created equal. Some have demonstrated long-term sustainability, while others have come and gone. Market leaders such as Bitcoin, Ethereum, Binance Coin (BNB), and Tether (USDT) have proven to be sustainable and profitable investments.

How Do You Invest in Crypto?

Exploring Investment Options

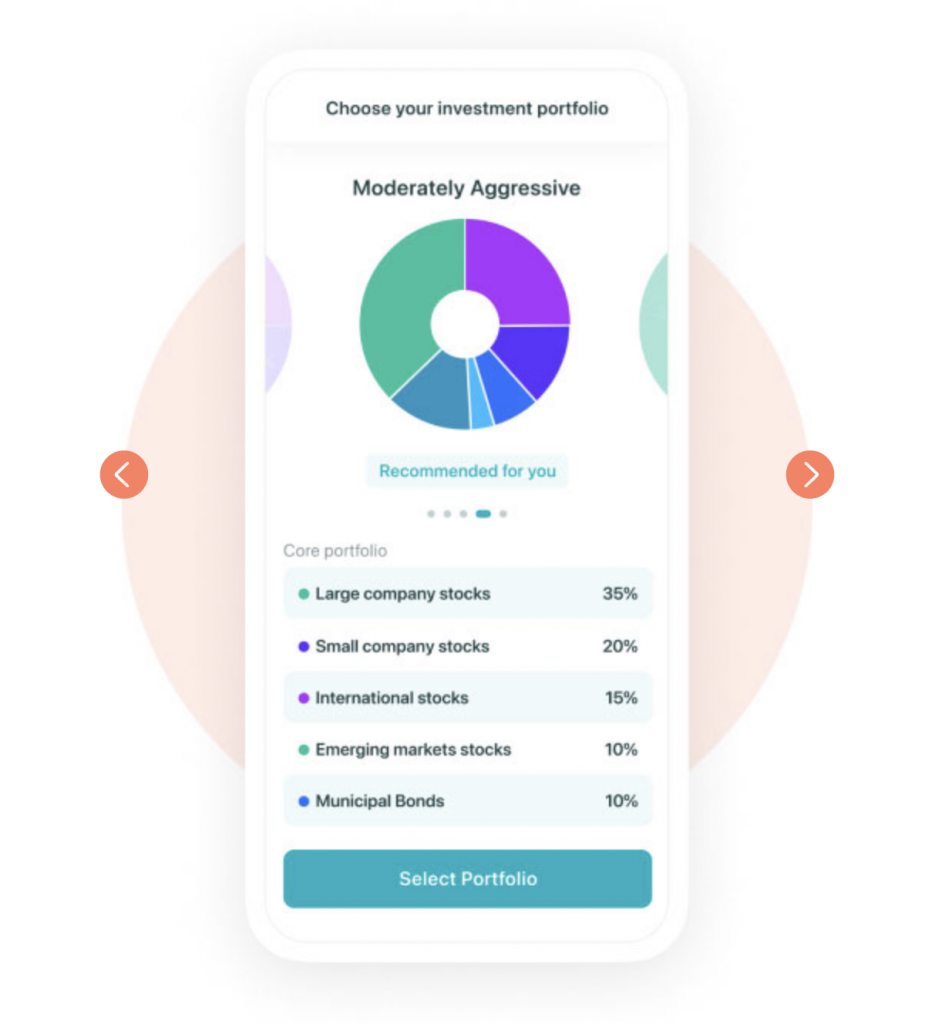

Investing in cryptocurrencies can be approached through various avenues:

- Purchase a Single Crypto Coin: The simplest method is to buy individual digital coins or tokens.

- Invest in a Crypto Mutual Fund: Invest traditional currency into a managed fund that trades cryptocurrency futures contracts.

- Invest in a Crypto Exchange-Traded Fund (ETF): ETFs can track a single cryptocurrency or a basket of different digital assets.

- Invest in a Crypto Index Fund: Crypto index funds allow investors to allocate traditional currency to a fund that tracks specific crypto indexes.

Your choice of investment method should align with your risk tolerance and investment goals. Each option comes with its advantages and disadvantages, so thorough research is essential.

Purchasing Crypto: Exchanges vs. Brokers

To buy crypto, you’ll need to choose between cryptocurrency exchanges and brokers. Exchanges facilitate direct trading between buyers and sellers, often offering lower fees. Brokers provide user-friendly apps and manage exchanges on your behalf but generally charge higher fees.

After selecting your platform, fund your account with traditional currency. This can be done through a one-off transaction or by linking your bank account. Be aware of credit card fees and interest rates for crypto purchases.

Once your account is funded, research and select cryptocurrencies that align with your investment goals. Many exchanges allow fractional purchases to accommodate various budgets.

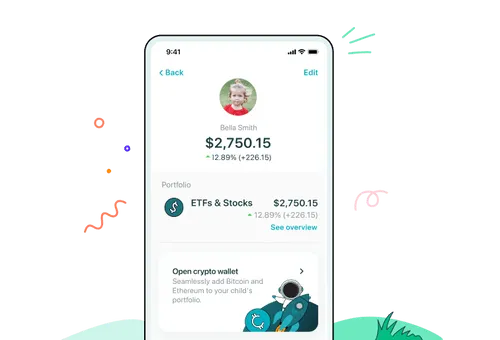

Storing Your Crypto

After purchasing crypto, secure it in a digital wallet. There are two main types of digital wallets:

- Hot Wallets: Online-based wallets suitable for frequent transactions

- Cold Wallets: Offline wallets offering enhanced security for long-term storage

Choose the wallet type that suits your needs and consider diversifying storage methods for added security.

Different Crypto Investing Strategies

Investing in crypto goes beyond purchasing and holding. Implementing a strategy can help you optimize your returns. Here are some common crypto investment strategies:

- Buy and Hold Strategy (HODL): This long-term approach involves purchasing crypto and holding it in your digital wallet with minimal trading. Ideal for building a nest egg over time.

- Earning a Yield: Hold crypto for a set period to generate returns, often through passive income. Buy low, sell high, and capitalize on price increases.

- Dollar-Cost Averaging: Invest fixed amounts of money into cryptocurrencies at regular intervals to minimize risk and take advantage of market volatility.

- Value Investing: Identify undervalued assets and purchase them with the expectation that their market price will rise over time. Requires extensive research and patience.

These strategies vary in risk and potential returns. Choose the one that aligns with your investment style and objectives.

Conclusion

In conclusion, the cryptocurrency market continues to grow and offers numerous opportunities for investors. With over 8,000 cryptocurrencies to choose from, it’s crucial to select the right investment strategy that aligns with your financial goals and risk tolerance.

Whether you opt for a conservative “buy and hold” strategy or explore more dynamic approaches, informed decision-making is key to success in the world of crypto investing. Start your crypto journey today to secure your financial future.

This guide has provided you with a comprehensive overview of crypto investing, empowering you to make informed choices in the rapidly evolving world of cryptocurrencies.

Comparing Crypto Investment Strategies

Compare different crypto investment strategies – Buy and Hold, Earning a Yield, Dollar-Cost Averaging, and Value Investing – to find the one that suits your financial goals and risk tolerance best.

| Strategy | Description | Time Horizon | Risk Level | Primary Goal |

| Buy and Hold (HODL) | Purchase and hold a cryptocurrency for an extended period. | Long-term (years) | Low | Long-term price appreciation |

| Earning a Yield | Buy and hold a cryptocurrency for a specific period, aiming to profit from price increases during that time. | Short to medium-term | Moderate | Short-term gains through price increases |

| Dollar-Cost Averaging | Invest fixed amounts of money into cryptocurrencies at regular intervals. | Long-term (years) | Low to moderate | Minimize risk through regular investments |

| Value Investing | Identify undervalued cryptocurrencies and purchase them with the expectation of long-term price appreciation. | Long-term (years) | Moderate to high | Capitalize on the potential of undervalued assets |

FAQ: Comparing Crypto Investing Strategies

Here are some frequently asked questions (FAQ) to help you compare and understand different crypto investing strategies:

Buy and Hold (HODL): This strategy involves purchasing a cryptocurrency and holding it for an extended period, often years. The primary goal is to benefit from long-term price appreciation, making it suitable for those looking to build wealth over time.

Earning a Yield: With this strategy, you buy a cryptocurrency and hold it for a specific period, aiming to profit from price increases during that time frame. The goal is to sell the asset at a higher price, generating a return. It’s a more active approach compared to HODLing.

Dollar-Cost Averaging: This strategy involves investing fixed amounts of money into cryptocurrencies at regular intervals, regardless of their current price. It is designed to minimize the impact of market volatility and spread out your investment over time.

Value Investing: Value investing aims to identify undervalued assets in the crypto market. Investors purchase these assets with the expectation that their market price will increase over time. It requires thorough research and a focus on the asset’s intrinsic value.

The “Buy and Hold” (HODL) strategy is typically more suitable for long-term wealth accumulation. By holding onto cryptocurrencies over an extended period, you have the potential to benefit from their long-term price growth. It is often favored by those looking to build a nest egg or investment portfolio for the future.

Yes, there are risks associated with the “Earning a Yield” strategy. Since it involves actively buying and selling cryptocurrencies to capture short-term gains, it can be more susceptible to market volatility.

Timing the market correctly is essential, and there is a risk of not achieving the desired returns if prices do not increase as anticipated.

Choosing the right strategy depends on your investment goals, risk tolerance, and time horizon. Here are some considerations:

If you seek long-term wealth accumulation with lower risk, “Buy and Hold” (HODL) may be suitable.

For those comfortable with active trading and seeking shorter-term gains, “Earning a Yield” or other active strategies may be preferred.

“Dollar-Cost Averaging” can be a balanced approach for minimizing risk while participating in crypto markets.

“Value Investing” requires in-depth research and is best suited for experienced investors with a long-term outlook.

Ultimately, the choice of strategy should align with your financial objectives and comfort level with market fluctuations.

Yes, you can switch between these strategies based on your evolving financial goals and market conditions. Investors often adapt their strategies to changing circumstances. It’s essential to stay informed about market developments and adjust your approach accordingly.

Remember that successful investing in cryptocurrencies requires ongoing research, risk management, and a well-defined strategy. It’s advisable to consult with financial professionals or advisors when making investment decisions.

Download Crypto Investing Strategies: The Complete Guide PDF

No Comments

Pingback: Crypto Investment Strategies: HODLing vs. Trading – Which Is Right for You? - Stock Traders Videos

Pingback: Crypto Trading Platforms: Comparing Binance, Coinbase, and Kraken - Stock Traders Videos