Introduction: Learning Stock Trading Through the Silver Screen

Movies have a unique way of captivating our attention and conveying complex concepts in an entertaining manner. When it comes to stock trading, a field often perceived as intricate and reserved for experts, several films have managed to demystify the subject and provide valuable insights into the world of finance. These movies not only entertain but also offer a glimpse into the dynamics of stock trading, the psychology of traders, and the impact of financial decisions. In this article, we’ll explore some of the best stock trading related movies that are worth watching anytime, whether you’re a seasoned trader or just curious about the world of finance.

The Big Short (2015): Unraveling the Financial Crisis

One of the most thought-provoking stock trading movies, “The Big Short,” directed by Adam McKay, takes us back to the events leading up to the 2008 financial crisis. The film follows a group of investors who saw the impending collapse of the housing market and decided to bet against it. Through brilliant storytelling and compelling characters, the movie breaks down complex financial instruments into digestible concepts. As a viewer, you’ll gain insights into how stock trading strategies can be employed to profit from market downturns, and you’ll also develop a deeper understanding of the factors that contributed to the crisis.

Wall Street (1987): Greed, Ambition, and Ethical Dilemmas

In Oliver Stone’s classic film “Wall Street,” the character of Gordon Gekko, played by Michael Douglas, utters the iconic line, “Greed is good.” The movie revolves around a young and ambitious stockbroker, Bud Fox, who becomes entangled in the world of insider trading and unethical practices. As you watch the rise and fall of Bud Fox, you’ll explore the ethical dilemmas faced by traders and the moral implications of putting profits above integrity. “Wall Street” serves as a cautionary tale, reminding us that success in stock trading should never come at the cost of our ethical compass.

Margin Call (2011): Unveiling the Financial Meltdown

“Margin Call,” directed by J.C. Chandor, offers a gripping narrative set against the backdrop of a fictional investment bank during the early stages of the 2008 financial crisis. The film provides a glimpse into the high-stakes world of trading and the difficult decisions faced by traders and executives as they grapple with the impending collapse of their firm. As you watch the characters navigate through the crisis, you’ll gain insights into risk management, the importance of transparency, and the interconnectedness of financial markets.

Boiler Room (2000): Unmasking Pump-and-Dump Schemes

“Boiler Room,” directed by Ben Younger, offers a revealing look into the world of pump-and-dump schemes and fraudulent stock trading practices. The film follows a young college dropout who joins a brokerage firm engaged in high-pressure sales tactics and illegal activities. As the story unfolds, viewers are exposed to the dangers of investing in companies manipulated by unscrupulous traders. “Boiler Room” underscores the significance of due diligence, ethical behavior, and the importance of making informed investment decisions.

Rogue Trader (1999): The Collapse of Barings Bank

Based on a true story, “Rogue Trader,” directed by James Dearden, recounts the downfall of Nick Leeson and the collapse of Barings Bank due to unauthorized trading activities. The film sheds light on the risks associated with unchecked trading behavior, the impact of overleveraging, and the lack of proper risk management. By delving into the events leading to one of the biggest financial scandals in history, “Rogue Trader” emphasizes the need for accountability, oversight, and the prudent management of investment portfolios.

Trading Places (1983): Humor and Market Manipulation

“Trading Places,” a comedy directed by John Landis, takes a humorous approach to exploring the dynamics of the stock market. The film follows two characters from different socioeconomic backgrounds who unwittingly become part of an elaborate trading experiment. Through witty storytelling, the movie touches on concepts such as market manipulation, insider trading, and the role of information in shaping stock prices. While providing laughs, “Trading Places” also offers a lighthearted introduction to some of the strategies and behaviors observed in the world of stock trading.

Inside Job (2010): Digging Deeper into the Financial Crisis

“Inside Job,” a documentary directed by Charles Ferguson, presents a comprehensive analysis of the 2008 financial crisis and its underlying causes. The film features interviews with economists, financial experts, and policymakers, offering a deep dive into the factors that contributed to the crisis. By examining issues such as regulatory failures, conflicts of interest, and excessive risk-taking, “Inside Job” prompts viewers to reflect on the systemic vulnerabilities of the financial industry. The documentary reinforces the importance of effective regulation, transparency, and accountability in maintaining the stability of financial markets.

The Wolf of Wall Street (2013): Excess, Consequences, and Compliance

Martin Scorsese’s “The Wolf of Wall Street” chronicles the extravagant life and eventual downfall of Jordan Belfort, a stockbroker who engaged in fraudulent activities. The film provides a cautionary tale of the consequences of unchecked ambition, excessive behavior, and ethical lapses in the world of finance. While the movie portrays the allure of wealth and power, it also underscores the importance of adherence to legal and ethical standards in stock trading. As viewers witness the highs and lows of Belfort’s career, they’re reminded of the need for integrity, compliance, and responsible financial practices.

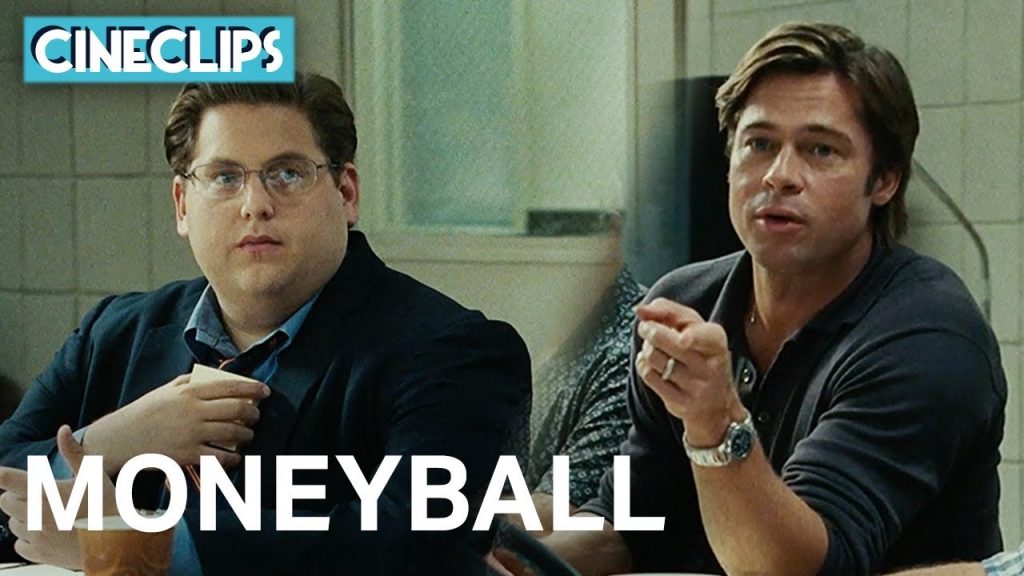

Moneyball (2011): Analytics and Innovation in Trading

While not exclusively a stock trading movie, “Moneyball,” directed by Bennett Miller, offers valuable insights into the application of data analysis and statistics in making informed decisions. The film revolves around the unconventional methods employed by the Oakland Athletics baseball team to build a competitive roster on a limited budget. By exploring the concepts of data-driven decision-making, risk assessment, and innovation, “Moneyball” provides a fresh perspective on how analytical approaches can be applied to stock trading strategies.

Pursuit of Happyness (2006): Determination and Financial Resilience

“Pursuit of Happyness,” directed by Gabriele Muccino and based on a true story, follows the journey of Chris Gardner as he overcomes immense challenges to pursue a career in stock brokerage. The film portrays Gardner’s unwavering determination, perseverance, and resilience in the face of adversity. Through Gardner’s experiences, viewers gain insights into the importance of hard work, continuous learning, and maintaining a positive mindset in the pursuit of success. “Pursuit of Happyness” serves as an inspirational reminder that the world of stock trading, like any endeavor, requires dedication and a willingness to overcome obstacles.

Floored (2009): Pits, Technologies, and Human Psychology

“Floored,” a documentary directed by James Allen Smith, provides a captivating look into the trading pits of Chicago’s futures exchanges. The film explores the evolution of trading technologies and strategies, from open outcry trading to electronic trading platforms. By delving into the chaos and intensity of the trading pits, “Floored” offers insights into the psychological factors that influence traders’ decisions, the role of intuition, and the challenges of adapting to changing market dynamics. The documentary showcases the human element of stock trading and underscores the importance of understanding market psychology.

Limitless (2011): Enhancing Cognition and Decision-Making

In “Limitless,” directed by Neil Burger, the protagonist gains access to a pill that enhances cognitive abilities, leading to remarkable success in various fields, including stock trading. While the film ventures into science fiction territory, it raises intriguing questions about the potential benefits and drawbacks of cognitive enhancement in decision-making. As viewers witness the protagonist’s meteoric rise and the consequences of his choices, they’re prompted to reflect on the fine balance between shortcuts and comprehensive analysis in stock trading. “Limitless” serves as a thought-provoking exploration of the limits of human potential and the ethical considerations of utilizing cognitive enhancement.

The Company Men (2010): Downturns, Downsizing, and Long-Term Vision

“The Company Men,” directed by John Wells, portrays the impact of corporate downsizing on the lives of several executives as they navigate unemployment and financial uncertainty. The film highlights the emotional and financial challenges faced by individuals affected by layoffs and offers a reflection on the broader economic implications of such decisions. Through the characters’ experiences, viewers are reminded of the importance of long-term financial planning, adaptability, and maintaining a holistic perspective on investments. “The Company Men” encourages us to consider the human dimension of stock trading and its implications on both individuals and society.

Conclusion: Lights, Camera, Learning!

In a world where stock trading can sometimes feel overwhelming and inaccessible, these movies provide an engaging and educational lens through which to understand the intricacies of the financial markets. Each film offers unique insights, whether it’s unraveling the complexities of the 2008 financial crisis, delving into the psychology of traders, or exploring the ethical dilemmas of the trading world. As you watch these movies, you’ll gain a deeper appreciation for the factors that influence stock prices, the risks and rewards of investment decisions, and the human dynamics that shape the financial industry. So grab some popcorn, settle into your favorite armchair, and let the silver screen be your guide to understanding the captivating world of stock trading.

Frequently Asked Questions:

- Are these movies suitable for beginners in stock trading? Absolutely! These movies are designed to be engaging and informative for individuals at all levels of familiarity with stock trading. They break down complex concepts into relatable narratives that can benefit beginners and seasoned traders alike.

- Do I need to understand finance to enjoy these movies? While some familiarity with financial terminology may enhance your viewing experience, the movies are crafted to be accessible to a general audience. You’ll find that the storytelling and character development make the subject matter engaging even if you’re not an expert in finance.

- Can I really learn about stock trading from movies? Yes, you can! While movies may not provide comprehensive tutorials on stock trading, they offer valuable insights into the mindset of traders, the dynamics of financial markets, and the consequences of different decisions. They serve as a starting point for further exploration and learning.

- Are there any real-life individuals featured in these films? Several of these movies are based on true stories or inspired by real-life events. Characters like Jordan Belfort, Nick Leeson, and Chris Gardner are portrayed based on their actual experiences, adding authenticity to the narratives.

- What’s the best way to apply the lessons from these movies to real-world trading? While the movies offer insights and lessons, it’s important to approach stock trading with a combination of knowledge, research, and practical experience. Consider using the concepts you learn as a foundation for developing your trading strategies and making informed decisions.

Remember, these movies are not substitutes for formal education or financial advice. Always conduct thorough research and seek guidance from financial professionals before making any investment decisions. Enjoy the movies, learn from their messages, and use them as a springboard to expand your understanding of the fascinating world of stock trading!